Bank and building society staff helped save customers from losing tens of millions of pounds to fraud last year.

By using what’s called the Banking Protocol staff are allowed, in very specific circumstances, to go against customers’ wishes if they believe a transaction looks suspicious.

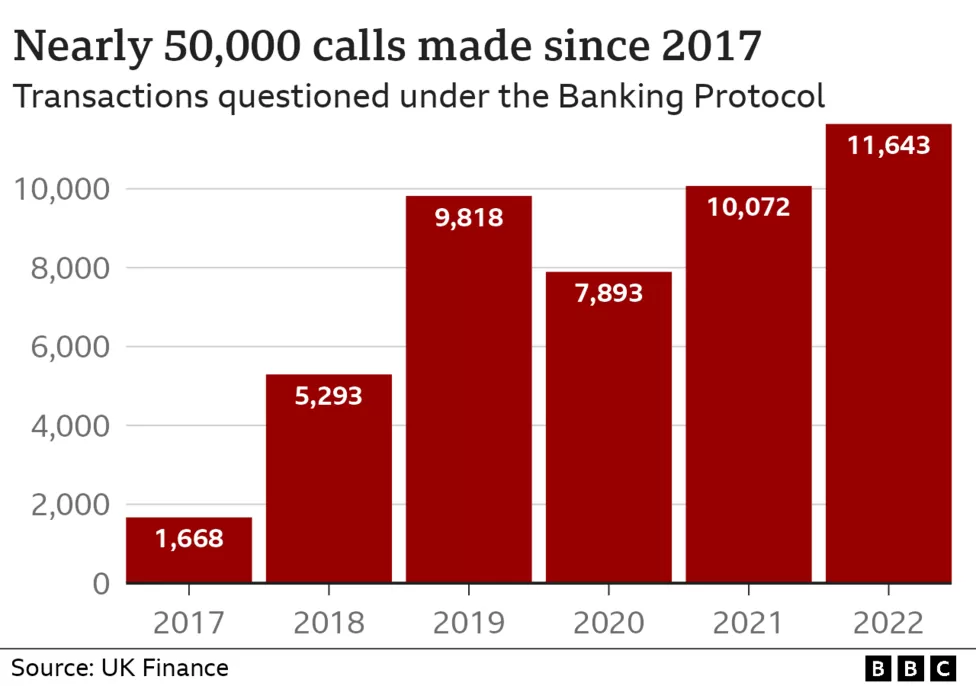

The emergency procedure was used 11,643 times in 2022.

Of those, transactions worth £55m were deemed to be fraudulent by police and staff, UK Finance said.

This led to nearly 200 arrests.

In total the protocol has saved £258m since it was introduced in 2017, according to UK Finance, the trade body for the banking industry.

‘He knew too much about her’

For the protocol to be able to be used, an employee has to believe a transaction is suspicious.

Some cases, on further investigation, might prove to be genuine. But when Sophie Williams at the Bromsgrove branch of the Nationwide Building Society used it she helped save one of her regular customers her life savings.

Late last year the customer, a lady in her 80s, came in with a young man claiming to be a family friend who said she had agreed to lend him £90,000 for an investment.

“He looked quite nervous, he spoke quite fast… [but] the biggest red flag for me was he spoke for her and I knew her,” said Ms Williams.

“He just knew too much about her. Even if you take your mum or your aunty shopping or to the bank you don’t necessarily know the figures in her bank account.

“It’s not unusual [for her] to help people out but that figure was just too much and given the amount it would leave her with it was just not acceptable.”

Ms Williams bought herself some time by asking the pair to go away and come back with some more ID and documentation and then set an alert on the Nationwide system in case the fraudster tried his luck at another branch.

When he brought the customer back in the next day with all the ID Ms Williams realised she had to use the Banking Protocol.

She spoke to her manager, who called the police, initiated the protocol with them and within five minutes two officers had arrived in the branch.

‘Preyed upon and groomed’

They took the customer and the fraudster into separate rooms, spoke to them both and agreed with Ms Williams that the desired transaction was fraudulent and should not go ahead.

The pair were subsequently taken to their respective homes separately and Ms Williams has not seen the “family friend” since.

Although most fraud is carried out online or over the phone, in this particular case, the fraudster was the son of an old friend of the customer, which was how he was able to target her in person.

“He had groomed her,” said Ms Williams. “He had been to her home, he had gone through her belongings and by the time she got to me she was really quite happy to give him this money which is the really sad thing.

“He was going to potentially take her life savings from her and would leave her with next to nothing. It was really alarming that she was so open and ok to give him these funds.

“She’d been preyed upon and she’d been groomed.”

Not every one of the cases of the Banking Protocol being used last year was a fraud. Some will have turned out to be genuine transactions but only after staff had asked the right questions.

There is also a limit to what action the police can take if they manage to prevent a fraud from happening.

However, since the Banking Protocol was introduced officers from across the UK have made more than 1,200 arrests because of it.

“Under the Banking Protocol, bank and building society staff are trained to detect the warning signs that someone is being scammed and make an emergency call to the police. By doing so, the police can intervene and prevent customers from passing life-changing sums of money to criminals,” UK Finance said.

Despite the scheme’s success, you are far more likely to be a victim of fraud than any other crime in the UK. Last year £1.2bn was stolen by fraudsters.

Fortunately for Ms Williams’ customer, her story was one with a happy ending.

“When I saw her [the customer] on the day we had to do the Banking Protocol she wasn’t herself and since then she’s been in with a family member who she’s been regularly seeing since.

“She was so upbeat and so grateful. And although this wasn’t a nice experience… it’s given her more support from family members who didn’t necessarily know she was so vulnerable.”

(Source: BBC)